Today, small businesses are turning to leasing as the preferred way to acquire the equipment they need to help grow their business. Leasing allows you use the equipment, machinery or tools you need without having to deplete your cash or spend time looking for a conventional bank lender. But how does equipment leasing work? Will your business benefit from it and is it the right choice for your business?

How equipment leasing works

When you lease equipment, you are renting it in a similar way you rent an apartment. The collateral for the lease is normally the equipment and the down payment is usually just the first one or two payments - you are usually held responsible for the monthly payments for the duration of the lease agreement.

At the end of the lease agreement, you have the option to terminate or renew the lease or even purchase the equipment for market value.

Benefits of Equipment Leasing

Here are four major reasons you consider leasing equipment:

- Control and conserve cash

Equipment leasing helps you to save working capital for daily expenses, business expansion and/or unexpected business related expenses. Also, you can sometimes structure your payments to meet your monthly, semi-annual or annual business cycles.

- Upgrade outdated equipment

Depending on the type of your business, equipment leasing will help you stay current with equipment and technology.

Also, if you plan to use the equipment for only a short time, you will find that leasing is a better option instead of buying and trying to resell when you no longer need it.

- Improve the balance sheet

Since monthly lease payments are viewed as an expense and not as a long term debt, you will have a smaller debt which means you can easily secure financing to fund your business.

- Potential tax benefits

Equipment leasing presents your small business with potential tax benefits, consult with your tax advisor.

Is leasing the right choice for your business?

When it comes to deciding whether to lease or not, you should focus on the equipment you want to acquire.

If you intend to use the equipment for only a short time, then leasing will be a better option. Also, if you are in a technology driven industry with a high equipment turnover, equipment leasing is the best solution.

Before you take the plunge, you should first examine the terms and conditions of the lease contract to know if it is the best decision for your business. If the overall cost of leasing helps you retain working capital and increases profits, then it may be a smart move for you.

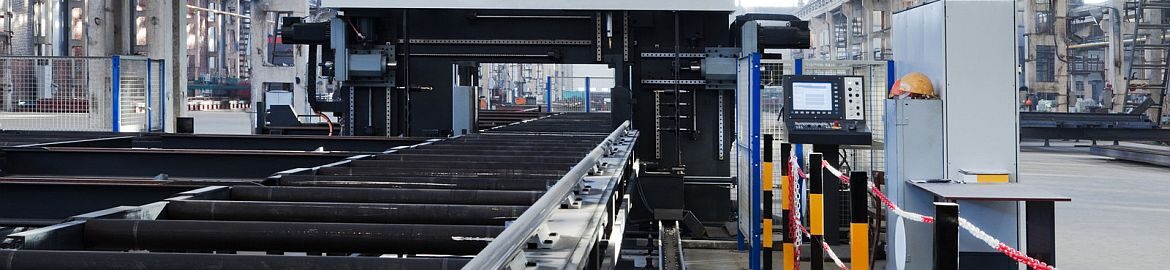

At Viking equipment finance, we have flexible equipment lease programs that are designed by a team of professionals to meet your specific business needs. Whether you are looking to construction equipment or industrial tools and machinery, we can probably help you.

We have a history of helping both small and large business owners and can arrange leasing for most types equipment. We focus on larger scale deals that range between $1 million and $55 million.

Allow us to take care of the credit searches, approvals, paperwork and asset management allowing you to concentrate on your business. Contact us today and we will be happy to help.